Beginner Series Part 1:

How points and miles work

Welcome to the freequent travel beginner Series! This short series of articles is dedicated to beginners who want to learn the fundamentals of using points and miles. This 8-part series will cover the following topics:

-

how points and miles work

The best way to fully grasp these basic concepts is to read each article in order, but do feel free to skip around to the articles that are most relevant to where you are in your points and miles journey. Feel free to also reach out to me directly if you have any questions about any of the topics covered, if you want to chat 1:1 about any of these topics, or if you'd like me to book travel for you with your points.

Wait, what exactly ARE points and miles?

Before we get ahead of ourselves, let's simply define points and miles. In short, they are a special currency. I call them "currencies" because like financial currencies:

-

They can be exchanged for something in return (ex: cash, flights, hotel stays, etc.)

-

Their values constantly fluctuate (and typically lose value over time)

-

In most cases, they are typically distributed by a specific entity (ex: only Chase will award you Ultimate Rewards points).

On the surface, it seems pretty simple, right? Well, yes and no. The points and miles game can be simple or complicated, depending on what you are looking to get out of it. There are SO MANY little details and hacks that can make the difference between getting $300 back in value vs $2,500+ back in value with the same amount of points. The stark difference in value comes down to understanding the interconnectivity between banks, merchants, loyalty programs, travel partnerships, and the math behind it all.

Why points programs exist

Points and miles programs were created by companies in the banking and travel industries as a way to reward customers for using their products and services. Over the last few decades, airline, hotel, and credit card companies have teamed up to find clever ways to keep their customers returning and spending with them. One of, if not the most effective, strategies has been the creation of loyalty programs that allow you to earn points and perks across dozens of hotel, airline, and credit card products. The way it works is pretty simple: spend with them, and they'll give you points to use for something in the future. With airlines and hotels, that "something" usually is a free night or some amount off of a future flight or stay. However, with credit cards, it can lead to much more in rewards, including status, discounts, and many more perks.

Spend with airlines, hotels, or on credit cards

Get rewarded with points and miles by spending

Redeem points for cash or travel awards

Types of points

Now that we know that points and miles are distinct currencies, let's discuss the TYPES of currencies that exist out there and their distinct characteristics

Airline miles

-

A type of currency that is earned through frequent flier accounts and can only be used to redeem flights

-

Examples: United MileagePlus miles, Delta Skymiles, American AAdvantage Miles

Airline programs where you can earn airline miles

Hotel points

A type of currency that is earned through hotel loyalty programs and can be used to redeem free hotel staysThey can sometimes be converted into airline miles, but at a very diminished value

Hotel programs where you can earn hotel points

Transferrable points

These are the most flexible points and can yield the most value, depending on the program and dollar:point ratio.Often marketed with "cash back" products, but often can be converted into airline miles or hotel pointsOf these three currency types, is any one of them the best? The short answer is "yes", and I'll even save you the suspense - it's transferrable points, but that does not mean that the other currency types don't matter. In fact, all three of them will play a part at some point in your points and miles strategy as it relates to redeeming for travel - but as far as prioritizing one over the other, transferrable points are king. If you're interested in why they are superior, check out this article where I go a little deeper on transferrable points .

Transferrable currencies

How points are earned

There are seemingly countless ways to earn points across the various programs that are out there. The most common ways to earn points are quite obvious, but they include flying with airlines, staying at hotels, and spending with credit cards. Considering the fact that you need a credit card to book either a flight or a hotel stay, the FASTEST way to earn points (aside from welcome bonuses) is to just travel! By traveling and using your points-earning card(s) to book your travel, you will see the points rack up quite quickly because not only will you be earning points and miles through the loyalty programs, but also because you will be earning points by spending on the card you use to book. However, the rate at which you earn is highly dependent on several factors, including (and certainly not limited to) the card you use, your status with the airlines and hotels you choose, and the site you use to book your travel. See below for examples of programs where you can earn points and miles. Note that these are just examples -- there are dozens more than what's listed below!

Earn miles by flying with airlines

Earn hotel points by staying at hotels

Earn points/miles by spending on credit cards

But ideally... You earn more by double-dipping!

+

+

Earn hotel points

AND credit card points/miles

AND/OR

Earn airline miles points

AND credit card points/miles

Redeeming points for travel

Redeem them directly from your points/miles account (bank, airline, or credit card) for travel

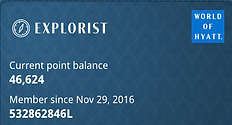

With 46,642 Hyatt points

Therefore, I can redeem 2 free nights at the Hyatt Regency in Paris

I can transfer 40,000 AMEX points & transfer them to Air France's Flying Blue program...

...and book a round-trip flight from New York to Paris.

Transfer them to a travel partner for airfare or hotel stays

I have 175,056 Chase points with my Sapphire Reserve Card

Therefore, I can book travel worth up to $2,625 via Chase Travel

Convert points for cash into your bank account

I can redeem 175,056 Chase points for $1,705.56 in cash to my bank account.

As you familiarize yourself with the various points and miles programs, you will start to notice that not all points are valued the same. In fact, different point values can vary pretty wildly even if it's for the SAME booking. For example, a night at the Park Hyatt in Milan is valued at €1,114 (USD 1,240). However, I can use 40,000 Hyatt points to book that same room for the same night, which values Hyatt points for this room at 3.1 cents apiece. If I were to use AMEX points to book that same room, it would cost me a whopping 124,000 points at a valuation of 1 cent per AMEX point!

Is this always the case? No. I can probably find a few scenarios where AMEX points are worth more than 3.1 cents, like when I used 50,000 AMEX points to book a business class seat on Air France to Italy this summer. The seats would have otherwise cost me $4,249, so in this scenario my AMEX points were worth a hefty 8.5 cents per point.

So which is the BEST way to redeem? The answer to this question is "it depends." Perception of value varies from one person to another. Since people have different goals, they might use their points in different ways. For instance, someone with a ton of Chase Ultimate Rewards points might find the best redemption options to be through Hyatt transfers whereas someone else might find great value through an Air Canada or British Airways transfer redemption. There is no formula that will tell you what to do with your points. It all comes down to preference and what YOU believe is the best option for YOU.

Where to get started

Now that you understand how points work at a basic level, it's time to get started. However, before you just dive in and start applying for credit cards, I must mention that there are a few things that you MUST consider before you do ANYTHING. There is somewhat of a process to this hobby, and I would be remiss if I did not lay out this process step-by-step and why each step is important. Continue reading below to learn what you need to do to get started.

Make sure your credit score is in good shape

Earning and redeeming points for travel will require good financial habits and discipline before you even swipe your brand-new card. It all starts with your credit score. A strong credit score (among other factors) is one of the most important keys to unlocking access to some of the most powerful and highly coveted cards on the market. If you can get your credit score in at least "good" shape, then you will be well-positioned to start acquiring cards to add to your portfolio. If you aren't sure what your current credit score is, I recommend creating accounts with Credit Karma or Experian, which will each give you your credit score as well a breakdown of each component of your credit report.

So what exactly is "good" credit? It depends, but a score of 680 or better will usually qualify you for some pretty decent beginner cards. In Part 3: How credit scores work, we will discuss each component of your credit report and ways to improve each of them so that you maximize your chances of being approved for the cards on your radar.

Assess your habits and lifestyle

To get to where you want to go, you need to formulate a strategy. And how do you do that exactly? A great best practice is to do some self-reflection, beginning with your spending habits. Do you spend a lot at grocery stores? At gas stations? At Costco? The categories and the names of the merchants where you spend will matter. I explain why this level of detail matters in Part 2: How credit cards work, where I discuss specifics about credit card networks and exclusive partnerships with merchants (spoiler alert: Costco only accepts Visa cards). A simple way of conducting this self-assessment is to log into your existing online bank accounts and review your statements for the last 12 months. Most, if not all, banks will have a function built into their site that allows you to look at your spend by category. You can then jot down and add up the total spend across all of your accounts (credit and checking accounts) and break it down by category. You should see a pattern, which should inform the type of cards you should go after. I should note that you should NOT drastically change your existing spending habits just for the sake of earning more points. It's likely that some of your habits will shift slightly to take advantage of point-earning hacks, but they should not be wildly different than they are today.

Acquire cards that fit your strategy

Consider the types of perks, benefits, and points/miles currencies that would make most sense for you. For example, does lounge access matter to you when you travel? Does extended warranty protection matter to you for any purchases you make? Do you prefer to fly United or stay at Hilton hotels? When considering adding a new card to your portfolio, you should first consider whether its benefits align with how you want to travel and whether the spend category multipliers make sense to you and your everyday spend habits.

Continue to reassess

This game requires continuously reassessing your circumstances, habits, and goals. Loyalty programs and credit card companies constantly evolve their programs and products to cater to their customers, often resulting in changes to fees, benefits, earning rates, partnerships, and status thresholds. If you want to stay ahead and ensure that you're still maximizing your earning potential and redemption values, it's necessary to continue evaluating your card portfolio and the programs in which you participate. I personally re-evaluate my card portfolio about every 6 months to make sure that the cards in my wallet still make sense and whether it still makes sense to travel the way I do. I encourage you to do the same (at your own cadence) so that you are able to maximize the value you're receiving.

Key points

We are just scratching the surface when it comes to rewards travel, and when it comes to grasping the concept of this hobby, it can seem very overwhelming. However, I am here to help explain how it works step-by-step and offer my perspectives based on my own experience. This journey should not be stressful nor should you feel like there is a "right and wrong" way of going about it. Every person is on a unique journey, and my goal is to simply uncover the many ways you can unlock free travel so that you can create memories with the people you love the most. Here are the key takeaways from this post:

-

Points and miles are awarded by companies as a way to reward you for using their products and services.

-

You can earn points by spending on credit cards, traveling on certain airlines, or staying at certain hotel brands.

-

There are many ways to use points and miles, and the values can vary across programs based on several factors.

-

Before you start, make sure your credit score is strong and that you've considered your habits and travel goals before getting a card.

I know I covered a lot here, but I encourage you to continue to Part 2, where I will review the basics of credit cards and how they work. There, I will cover the different card networks and how they can affect pricing and card acceptance by merchants, which can significantly affect your strategy.

The Chase Sapphire Preferred® Card

Current Welcome Offer

100,000 Membership Rewards Points after spending $4,000 in the first 3 months of card membership

The American Express® Gold Card

Current welcome offer

90,000 Membership Rewards Points after spending $6,000 in the first 6 months of card membership

The American Express® Platinum Card

Current welcome offer

125,000 Membership Rewards Points after spending $8,000 in the first 3 months of card membership

Top Card Picks

Subscribe to our newsletter to stay on top of the latest news, direct to your inbox.